ACA Compliance Services

Confident Compliance Starts Here. Meet ACA Requirements with Ease.

isolved ACA Compliance Management add-on includes everything you need to remain compliant amidst the tangle of complex regulations and legal requirements.

What is ACA?

The Affordable Care Act (ACA) extends healthcare protection to employees, no matter where they are in the employee lifecycle. Applicable large employers (ALEs) are required to generate, distribute and file IRS forms for applicable employees. While it's a core element of a competitive benefits package, administration can be incredibly time-consuming and demanding for HR teams.

How It Works

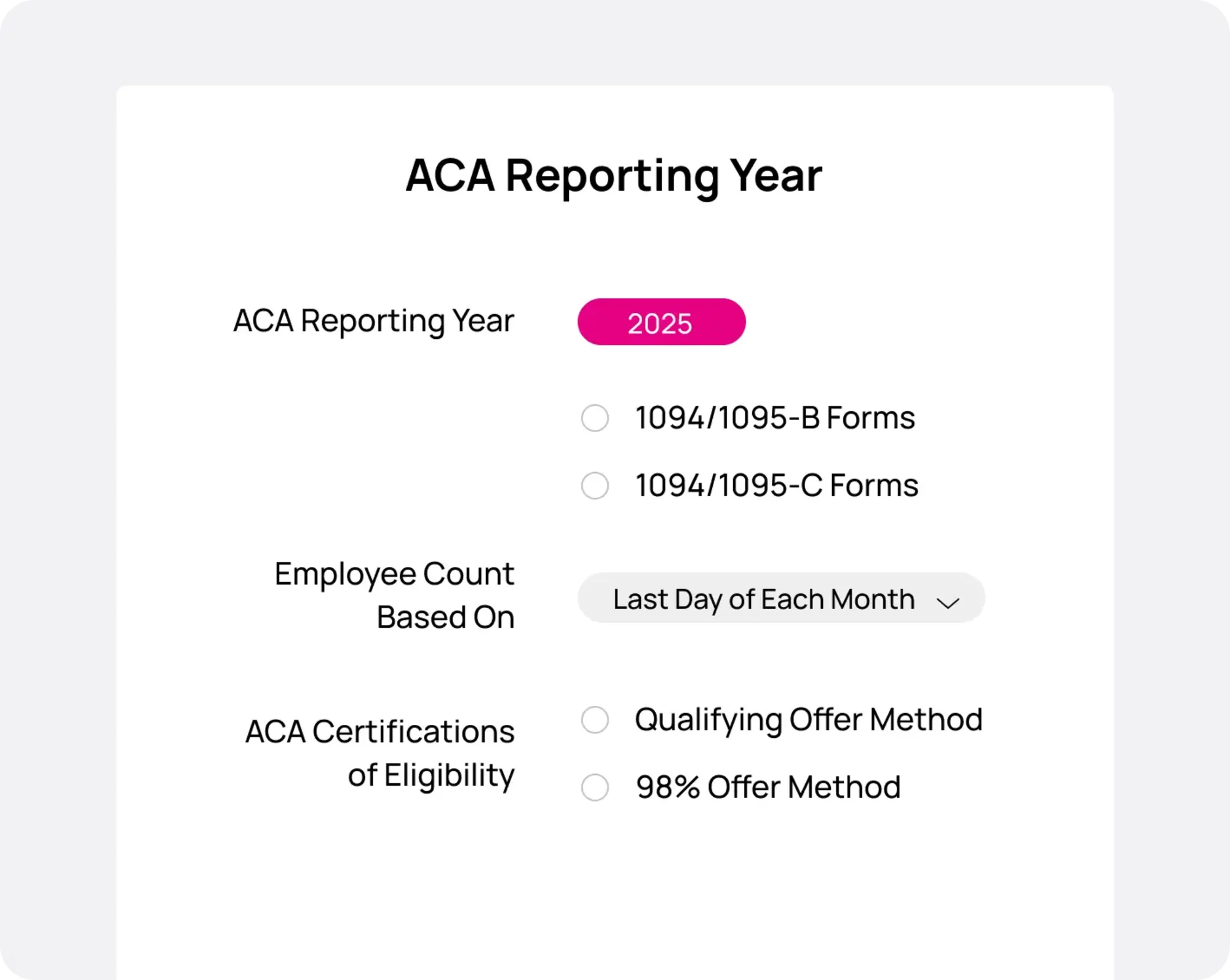

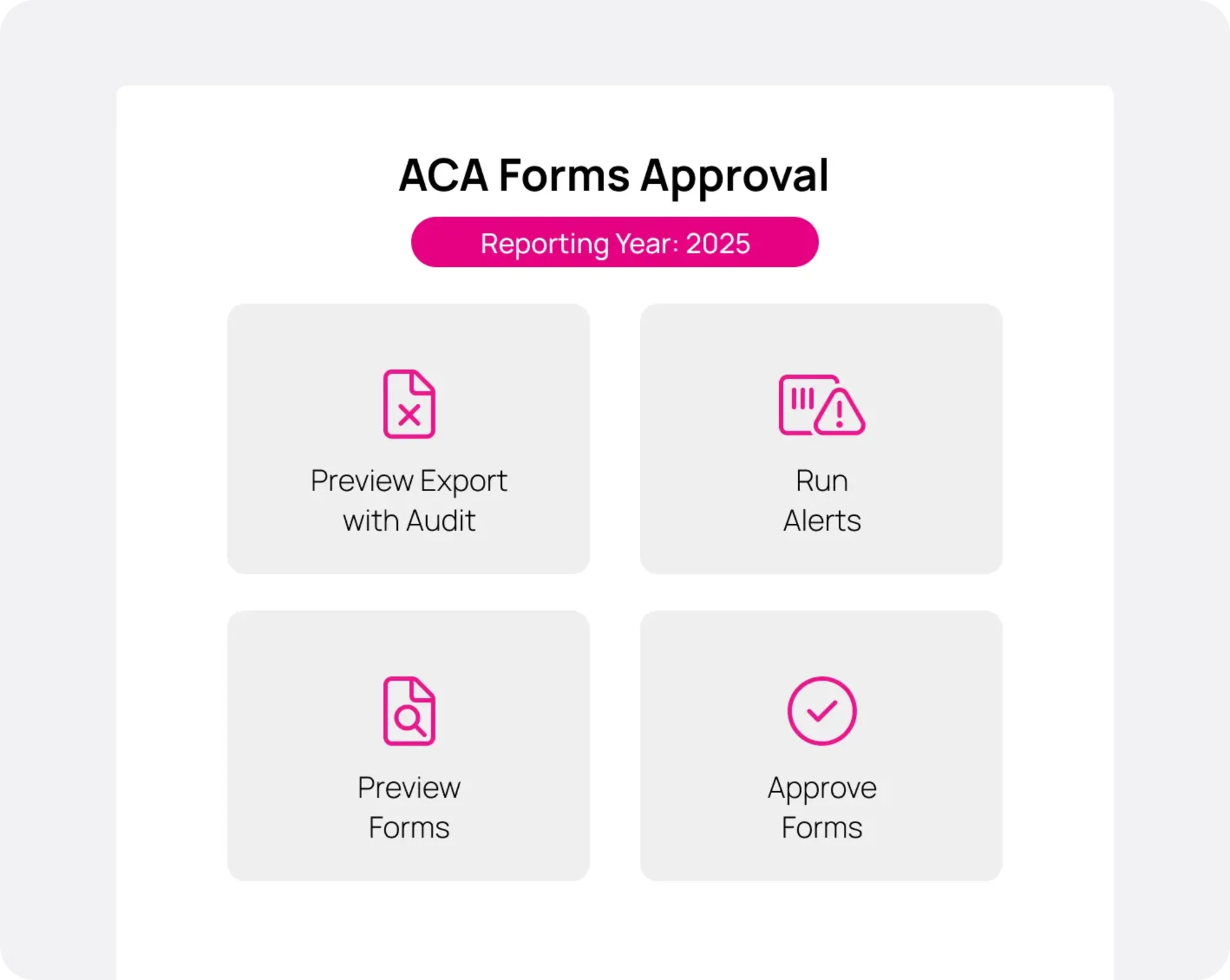

isolved's ACA solution streamlines compliance with built-in tools that manage the process from start to finish. HR leaders can easily generate and file applicable forms, run ALE status reports and monitor regulatory requirements. Our approach helps you proactively manage compliance while ensuring confidence in your annual filings.

ACA Print and File

ACA Print & File simplifies the reporting process for ALEs. You can download a hard copy of IRS Forms 1094-C and 1095-C, while isolved helps manage distribution and e-filing on your behalf. Let us streamline the process and eliminate the stress of ACA reporting and shield you from costly missteps.

Key Features

isolved's ACA Compliance Management add-on is designed with your people in mind.

Save Time and Boost HR Efficiency

isolved expertise can relieve the resource- and time-intensive burden of ACA compliance year after year. Save valuable time and energy on heavy administrative lifts, so you can focus on what matters most: your people.

Mitigate Risk and Ensure Compliance

Don't fear fines when it's time to file your annual 1094-C and 1095-C forms. Avoid costly missteps and IRS penalties by ensuring timely and accurate reporting in a complex space.

Increase Employee Satisfaction and Well-Being

ACA is a core component of a competitive benefits package that extends peace of mind to your employees. Meet them where they're at with expert care.

“I really like the reports and how I can customize them to show me pretty much any information needed. isolved has a great support staff and I’m able to call and get help immediately.”

Lacey Davidson

HR Manager at JumBurrito

ACA Compliance Solution FAQs

Get quick answers to common questions about ACA Compliance Services. Learn what your organization needs to know to meet employer mandate requirements and avoid costly penalties.

Reduce Risk and Stay Compliant

Make ACA compliance effortless with expert guidance that boosts HR efficiency.