Commuter Benefits

Easy, Automated Transit & Parking Benefits

Give your employees a cost-effective way to commute while lowering your payroll taxes. With isolved, commuter benefits are simple to set up and manage with integrated payroll, commuter debit cards, direct-pay options and reporting that scales for hybrid workplaces.

Why Choose isolved for Transit & Parking Plans

Pre-tax commuter benefits under IRS Section 132(f) lower taxable income for employees and reduce FICA costs for employers. With isolved People Cloud™, elections sync automatically with payroll, contributions stay within monthly limits, and participants can pay providers with a debit card or submit reimbursements in the app. You'll get streamlined administration, compliant controls and real-time insight across all locations.

Benefits for Your Employees

Save with pre-tax dollars on eligible transit and qualified worksite parking.

Pay with a commuter debit card or direct pay to parking providers.

Submit claims and check balances through the mobile app (per plan rules).

Stay on track and maximize savings with clear monthly limits and reminders.

Make adjustments to contributions to fit hybrid or changing schedules.

Benefits for Your Business

Reduce employer payroll taxes on employee pre-tax contributions.

Eliminate duplicate entries and manual files with integrated payroll and benefits.

Stay compliant with IRS monthly limits and eligible categories with built-in security.

Get centralized reporting by location, cost center and benefit type.

Rely on expert guidance on plan setup, notices and year-end compliance.

What Expenses Are Eligible?

Transit: Passes for bus, subway, commuter rail, ferry and eligible vanpool.

Parking: Qualified parking at or near the workplace or park-and-ride lots.

Ineligible examples: Fuel, tolls, mileage, rideshare/taxi for personal trips, residential parking.

Note: Eligibility and monthly limits are set by the IRS and may change annually—your isolved team keeps you current.

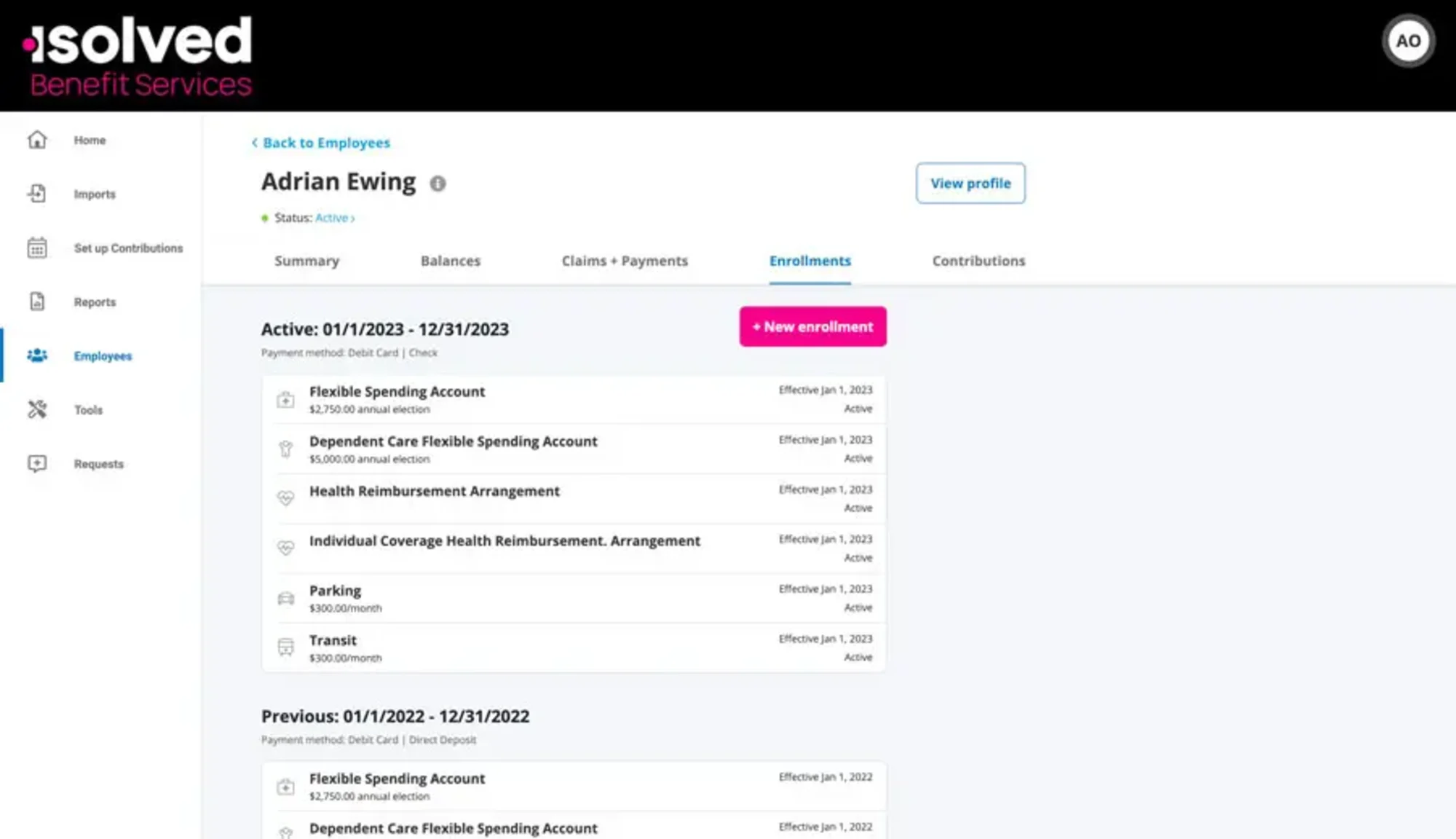

How Transit & Parking Plans Work in isolved

Configure your plan with locations, eligibility, provider options and contribution caps.

Enroll employees and set contributions that respect IRS monthly limits.

Pay and ride using the commuter card, direct-pay parking or app reimbursements.

Manage with automated payroll deductions and audit-ready reporting.

Commuter Benefits FAQs

Qualified transportation accounts help employers support tax-free commuter benefits while reducing payroll taxes. Use the FAQs below to understand how these accounts work for your workforce.

Lower Commuting Costs Without the Admin Burden

See how Transit & Parking accounts in People Cloud deliver compliant savings for employees and employers.