What You Need to Know About the SECURE 2.0 Act

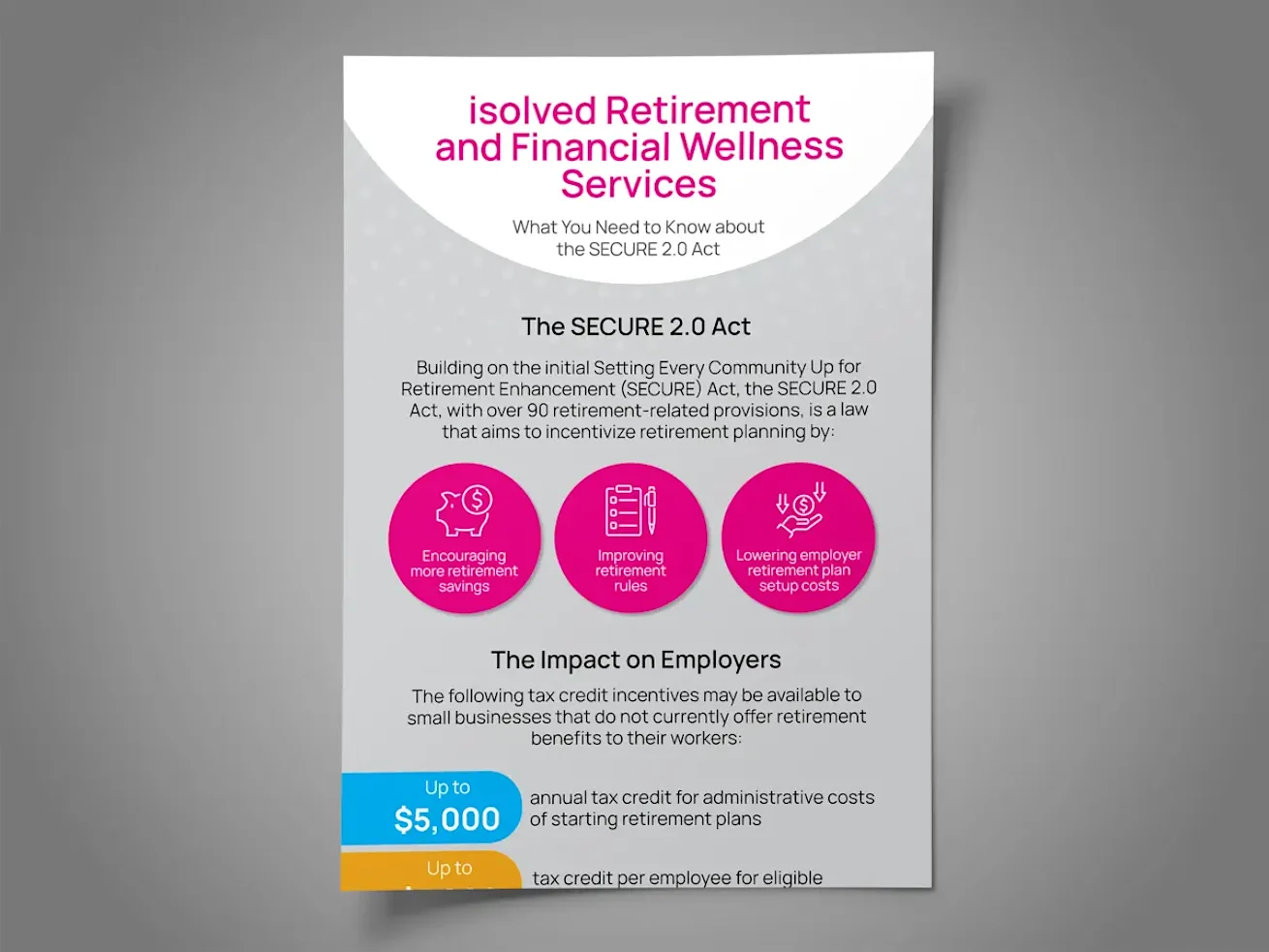

Is your organization ready to reap the benefits of the SECURE 2.0 Act? With over 90 new provisions, this legislation is designed to help employers lower plan setup costs and enable employees to save more for retirement.

Download our infographic to learn:

How you could save up to $5,000 in tax credits

New rules that make retirement planning easier

How automatic enrollment and contribution limits can boost employee buy-in

By submitting this information, I consent to receiving marketing communications from isolved, including emails and phone calls. Please see our Privacy Policy to understand how isolved handles your personal information - For California residents, please click here.

Related Content

5 Trends Shaping Advisory Growth for Brokers

What are brokers hearing from clients right now? This infographic shares insights into evolving client expectations and highlights five trends shaping advisory growth for the year ahead.

Read More

The Data Behind a Better Open Enrollment Experience

Want to create a better open enrollment experience? Check out these insights highlighting what HR leaders and full-time employees say what's working and what's not working.

Read More

The State of Restaurant People Strategy

What's needed to cook up a positive employee experience within the restaurant industry? Find out with these insights on hiring, retention and more.

Read More