FSA Administration

Smarter FSA Management for Your Team

With a flexible spending account (FSA) through isolved, employees can use pre-tax dollars to manage everyday healthcare costs and dependent care expenses. Employers save on payroll taxes and reduce administrative burden, keeping the focus on delivering a positive employee experience.

Why Choose isolved for FSAs

FSAs help employees stretch their paychecks while helping employers lower FICA liability. With isolved People Cloud™, you get integrated payroll and benefits, mobile self-service, a benefits debit card, automated substantiation and real-time visibility for HR—all supported by experienced compliance specialists.

Benefits for Your Employees

Spend pre-tax dollars on eligible medical, dental and vision expenses.

Instant access to funds with a benefits debit card and mobile wallet support.

Submit claims in minutes—snap a photo of the receipt in the app.

Real-time balances, contribution tracking and alerts keep participants on budget.

Helpful tools for open enrollment and education reduce confusion.

Benefits for Your Business

Reduce taxable payroll and capture employer FICA savings on employee contributions.

Fewer manual tasks—eligibility, payroll deductions and file feeds are synchronized.

Built-in rules and workflows support substantiation and plan compliance.

Analytics and reports for finance, HR and brokers in one place.

Dedicated support for plan design, renewals and year-end activities.

FSA Plan Types We Support

Healthcare FSA: Use pre-tax funds for copays, prescriptions, dental, vision and more.

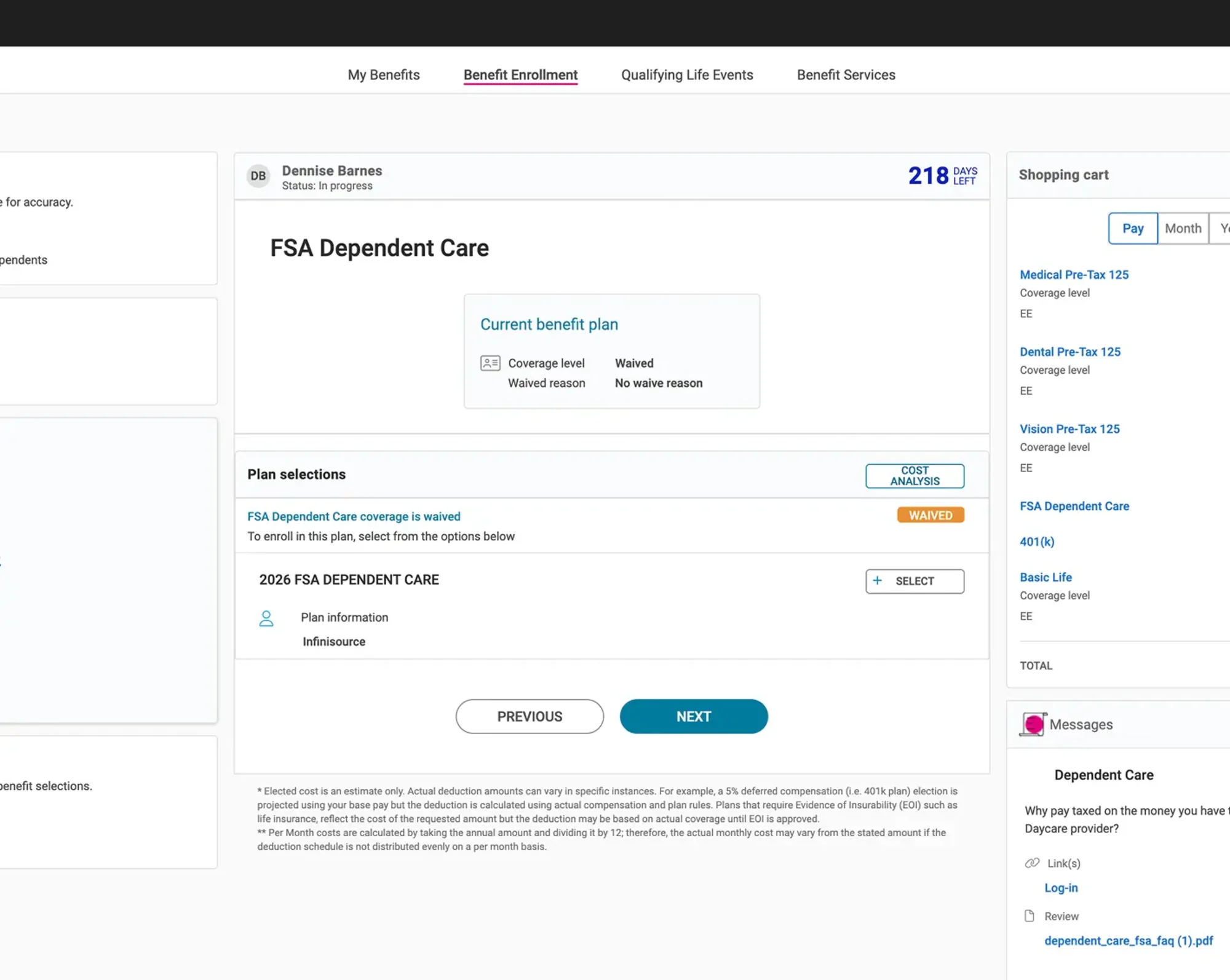

Dependent Care FSA: Cover eligible child or elder care expenses while you work, with pre-tax funds.

Limited-Purpose FSA: Pair with an HSA for dental and vision expenses.

Annual IRS limits and plan rules may change—your isolved team keeps you current.

How FSAs Work in People Cloud

Configure your plan with eligibility, contribution limits, rollover or grace options.

Enroll employees in People Cloud or through guided self-service.

Spend and submit using the debit card or file claims in the app with receipt capture.

Manage automated deductions, substantiation, reimbursements and reporting.

Empower Your Team with Flexible Benefits

Strengthen your benefits strategy with connected offerings in People Cloud.

Health Savings Accounts (HSAs)

Give employees in high-deductible health plans tax-advantaged ways to save, invest and spend with ease.

Health Reimbursement Arrangements (HRAs)

Offer flexible, employer-funded plans that help control costs and cover targeted expenses with simple administration.

COBRA Administration

Stay compliant and protect employees' experience with automated notices, payments and reconciliation.

FSA Administration FAQs

Flexible spending accounts (FSAs) let employees use pre-tax dollars for eligible healthcare and dependent care expenses. Get answers on how FSAs work, their benefits and what HR leaders need to know for effective plan administration.

Get Started

Help employees save on everyday healthcare costs while your business saves on payroll taxes and administrative time. Discover how FSAs in People Cloud simplify compliance and streamline benefits management.