HSA Administration

Boost Your Benefits Strategy with Smarter HSA Administration

Give employees more choice and control over their healthcare while lowering your organization’s costs. Pairing a health savings account (HSA) with a high-deductible health plan (HDHP) means lower premiums for you and long-term savings for them—all with the tax advantages you both want.

How HSAs Work

With an HSA, earnings on employee contributions are tax advantaged. They aren't subject to taxation. HSAs are funded by pre-tax employee contributions, and employers or third parties can also contribute. Employees decide how much to set aside each paycheck before payroll taxes are deducted, which increases their take-home pay. At the same time, employers pay less in FICA and FUTA payroll taxes.

Comparing HSAs and FSAs

Like a flexible spending account (FSA), funds in an HSA can be used to cover qualified medical expenses, such as co-payments, prescriptions, dental work, vision care and more. Unlike an FSA, though, HSA balances roll over from year to year, so employees never lose their savings. They can also take the balance with them if they change plans, retire or leave your organization.

HSA vs. FSA

HSA

• HSA-qualified plan

• Lower premiums

• Higher deductibles

• Cover premium payments

• Funds don’t expire

FSA

• Traditional health plan

• Higher premiums

• Lower deductibles

• Doesn’t cover premium payments

• Funds expire

Investment Benefits of an HSA

Employers may want to offer an HSA for its investment potential. Participants can grow their balance by investing HSA dollars in mutual funds, stocks or other investment tools. HSAs also benefit retirees, since funds can be used for non-qualified expenses after age 65. However, contributions must stop once an employee turns 65 and is enrolled in Medicare.

HSA vs. 401(k)

HSA

• 100% tax-deductible contributions

• Tax-free earnings

• Tax-free distribution for medical expenses

• Regular expenses taxed as ordinary income

• No required minimum distributions

401(k)

• FICA taxed contributions

• Tax-free earnings

• Medical expenses taxes as ordinary income

• Regular expenses taxed as ordinary income

• Minimum distributions required

Contribution Limits

The more you contribute to an HSA, the more you can save. Contribution limits change annually and vary between individual and family coverage. Participants who are 55 or older can contribute an additional $1,000 each year, known as a catch-up contribution.

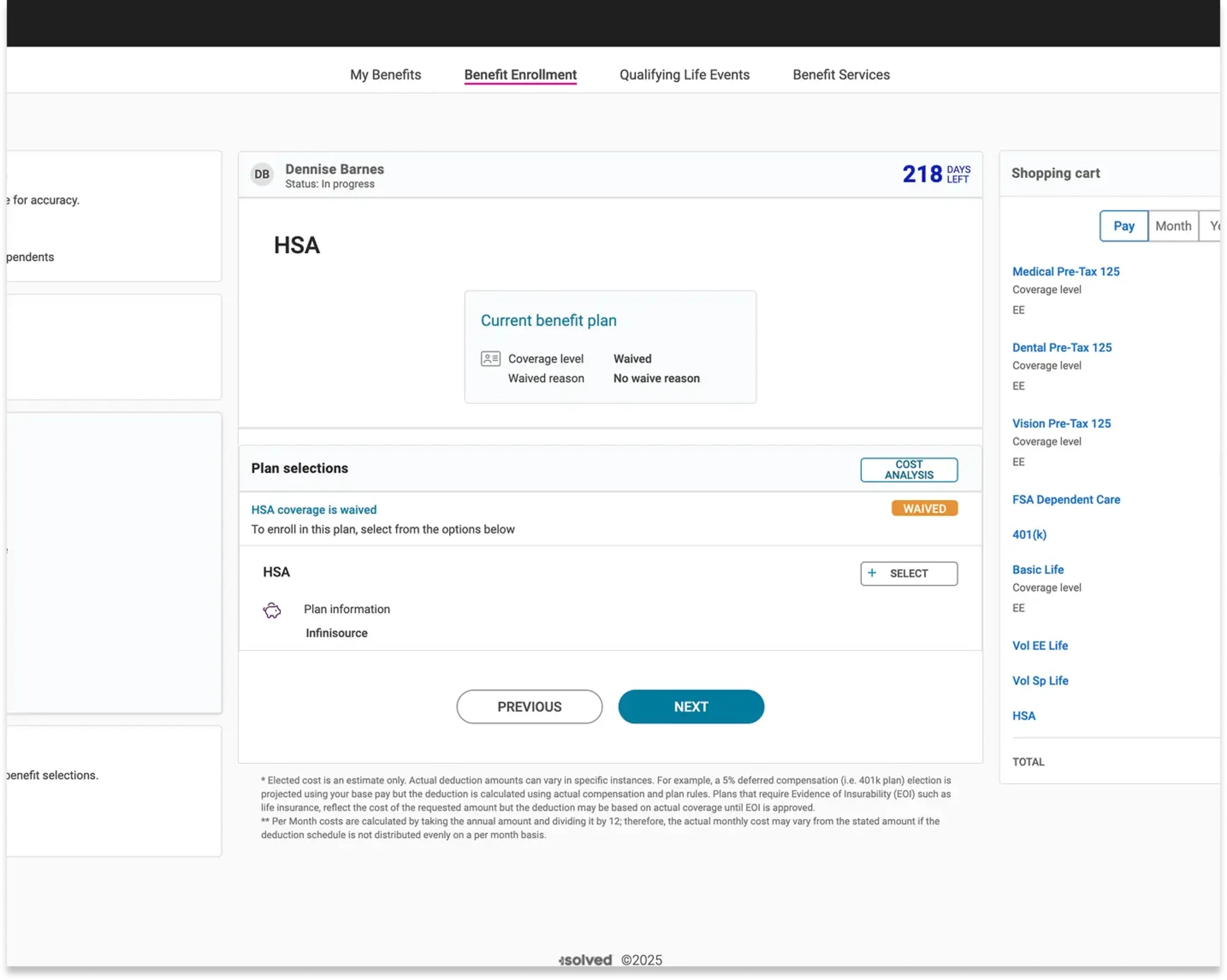

Make Administering HSAs Easy

With an HSA through isolved, employees get secure access to their accounts at anytime along with convenient debit cards to pay for qualified expenses at the time of service. You get dedicated HR support for claims and account questions, all within a single platform that makes flexible benefits easy to manage on any device.

HSA Administration FAQs

Get quick answers to common questions about health savings account (HSA) administration, compliance and benefits strategy. Designed for HR leaders, this FAQ supports effective, tax-advantaged healthcare planning within your employee benefits package.

isolved Benefit Services

Managing benefits can be complex and time-consuming. Let isolved help you stay compliant while giving employees the benefits they want and need.