Premium Only Plans

Score Big Wins for Employees With Premium Only Plans

If your organization is spending a lot on healthcare coverage, a Premium Only Plan (POP) can help. With a POP, employees benefit because their taxable income is lessened, while your business saves on costly insurance premiums and other costs for providing healthcare coverage.

Why Choose isolved for POP

A POP is the fastest way to deliver immediate tax savings for you and your employees. isolved People Cloud™ streamlines plan creation, employee elections, payroll deductions and year-end reporting—backed by compliance support for Section 125 rules. From adoption agreements to life-event changes and testing, we handle the details so you can focus on your people.

Benefits for Your Employees

Increase take-home pay by paying insurance premiums pre-tax.

Save time with automatic payroll deductions for medical, dental, vision and other eligible premiums.

Make open enrollment easier with clear, mobile self-service.

Get year-round support and guidance for qualifiers like marriage or the birth of a child.

Access transparent paystubs and real-time balances in the employee app.

Benefits for Your Business

Lower employer payroll taxes (FICA/FUTA where applicable).

Eliminate manual updates and file feeds with integrated payroll and benefits.

Simplify accounting with auto-applied pre-tax deduction codes and GL exports.

Stay compliant with built-in plan documents, employee notices and nondiscrimination testing.

Track ROI with analytics that quantify savings and participation for finance and HR.

Premiums Typically Eligible Under a POP

Employee portion of employer-sponsored medical, dental and vision premiums.

Certain supplemental health premiums (per IRS and plan design).

Health savings account (HSA) contributions via payroll (if permitted by your plan).

Pre-tax commuter benefits are available separately and can complement a POP.

Eligibility and tax treatment depend on IRS rules and plan documents—your isolved team helps configure what applies to you.

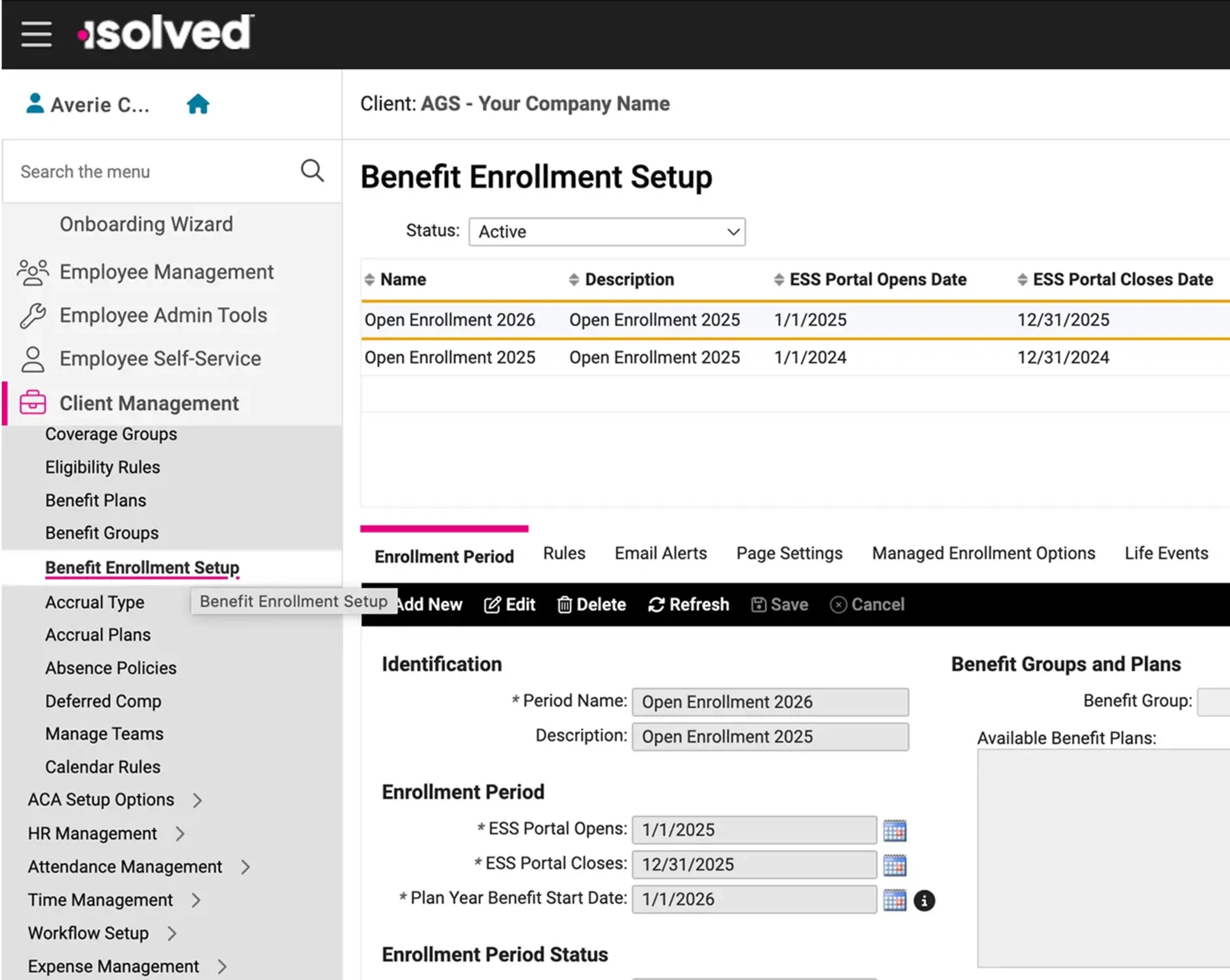

How a POP Works in isolved

Configure your plan by setting plan year, eligible premiums, eligibility classes and election rules.

Publish elections during open enrollment and allow permitted mid-year changes.

Automate payroll with pre-tax deductions, employer savings tracking and general ledger output.

Stay compliant with plan documents, required notices and annual Section 125 testing.

Deliver More Value with Related Solutions

Expand tax-advantaged benefits with these connected offerings in isolved.

Flexible Spending Accounts (FSAs)

Help employees cover eligible expenses with pre-tax dollars, integrated seamlessly with payroll and benefits.

Health Savings Accounts (HSAs)

Give employees in high-deductible health plans tax-advantaged ways to save, invest and spend with ease.

COBRA Administration

Stay compliant and protect employees' experience with automated notices, payments and reconciliation.

Premium Only Plan FAQs

Find straightforward answers to common questions about Premium Only Plans (POPs), Section 125 and pre-tax employee benefits. This FAQ supports HR leaders managing health plan costs and benefits administration.

Unlock Easy Tax Savings with a POP

See how POPs in People Cloud lower costs, simplify payroll and improve the employee experience.