HRA Benefits

Simplify HRA Management and Support Employees

Give employees tax-free reimbursement for eligible health expenses, while keeping your total benefits spend under control. With isolved, health reimbursement accounts (HRAs) are simple to design, launch and manage in one connected system with streamlined claims, automated substantiation and clear reporting.

Why Choose isolved for HRAs

An HRA through isolved can help you control healthcare costs with predictable budgets while giving employees tax-free reimbursement for qualified medical expenses. With isolved People Cloud™, you can design plans, manage enrollment, process claims and issue reimbursements in one place.

Benefits for Your Employees

Receive tax-free reimbursements for eligible medical, dental and vision expenses based on your plan.

Skip payroll deductions with employer-funded allowances.

Get reimbursements fast via benefits card or mobile app with receipt capture.

View real-time balances, notifications and guidance to reduce confusion.

Access helpful education during open enrollment and year-round support.

Benefits for Your Business

Control costs with defined allowances, eligibility classes and covered categories.

Get tax-advantaged benefits with reimbursements that are generally tax-free to employees and deductible to employers.

Automate workflows for substantiation, payments and documentation.

Use integrated reporting for HR and finance, no chasing down spreadsheets.

Rely on expert support for plan setup, renewals and audits.

HRA Plan Designs We Support

Integrated HRA: Pair with a group health plan to cover out-of-pocket costs.

Individual Coverage HRA (ICHRA): Provide defined allowances for employees enrolled in individual coverage, including premiums.

Excepted Benefit HRA (EBHRA): Add a modest allowance for excepted benefits like dental/vision and COBRA premiums.

HSA-Compatible Options: Design limited-purpose or post-deductible HRAs to preserve HSA eligibility.

Rules and annual limits may change—your isolved team keeps you current.

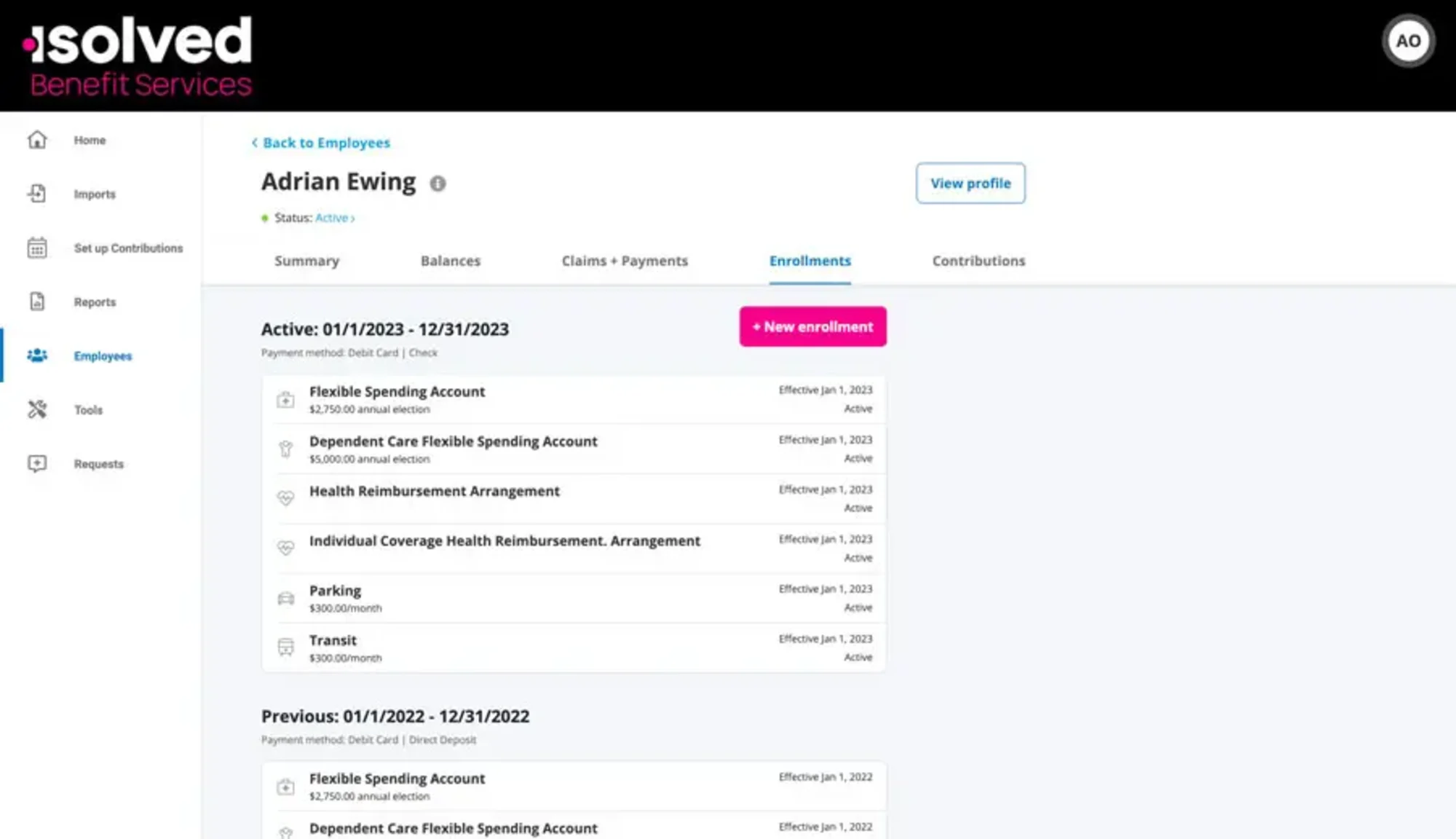

How HRAs Work in isolved

Configure your plan with allowances, classes, eligibility, rollover or grace options and covered expenses.

Enroll participants through guided self-service and verify coverage when required (e.g., ICHRA).

Spend and submit using the benefits card or file claims in the app with receipt capture; premiums can be set up for recurring reimbursement.

Manage and measure with automated payments, substantiation, communications and audit-ready reporting.

Empower Your Team with Flexible Benefits Accounts

Strengthen your benefits strategy with these connected offerings in People Cloud.

Flexible Spending Accounts (FSAs)

Help employees cover eligible expenses with pre-tax dollars, integrated seamlessly with payroll and benefits.

Health Savings Accounts (HSAs)

Give employees in high-deductible health plans tax-advantaged ways to save, invest and spend with ease.

COBRA Administration

Stay compliant and protect employees' experience with automated notices, payments and reconciliation.

FAQs about HRA Benefits

HRAs help employers offer tax-free reimbursement for qualified health care expenses while maintaining control over benefits budgets. Get answers on how these accounts are funded, what expenses are eligible, how HRAs interact with other accounts like HSAs or FSAs and what options exist for plan design.

Control Benefit Costs Without Compromising Care

See how HRAs in People Cloud deliver flexibility for you and clarity for employees.