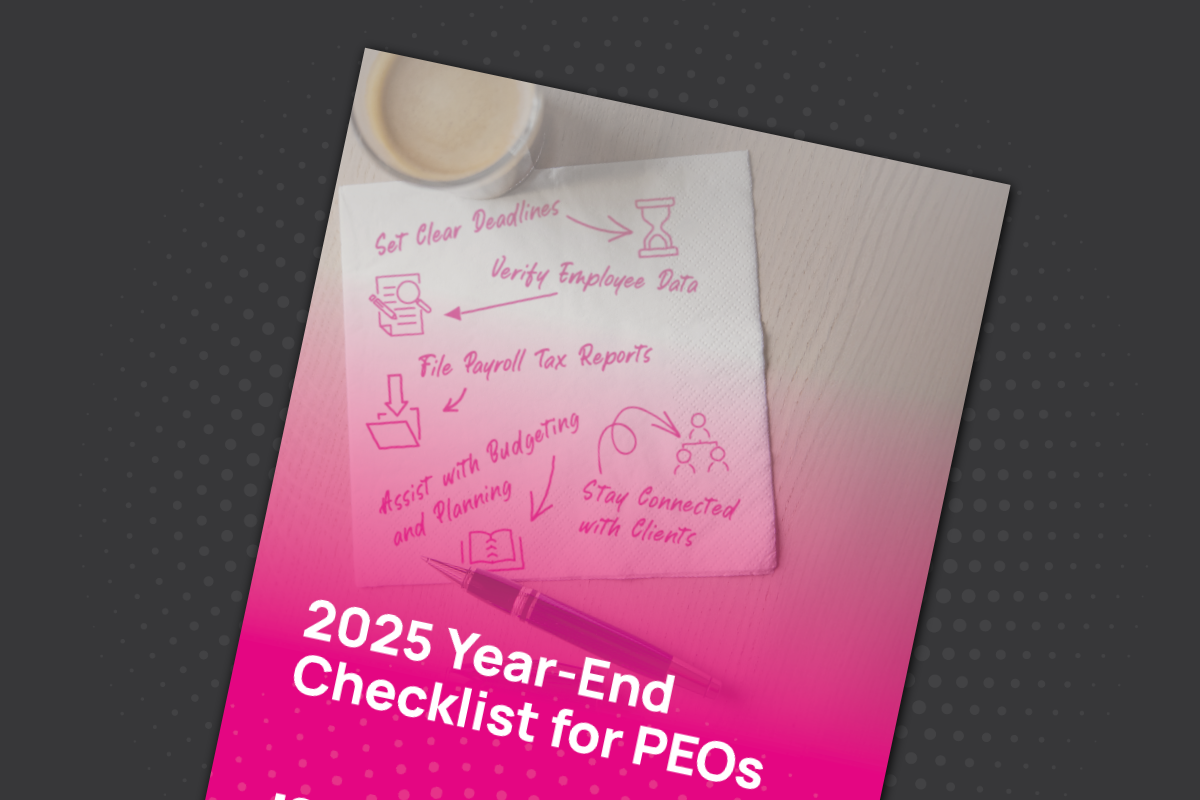

Managing year-end doesn’t have to be stressful for you or your clients. The 2025 Year-End Checklist for professional employer organizations (PEOs) gives you a clear roadmap to support compliance, meet deadlines and deliver a seamless client experience.

Here’s how it helps you support your clients:

- Keep them compliant with tax laws, regulations and deadlines

- Simplify W-2s, 1099s and tax reconciliation with easy-to-follow steps

- Build trust with proactive communication and clear expectations

From preparing tax forms to planning audits and client check-ins, this checklist equips you to guide clients confidently into the new year.