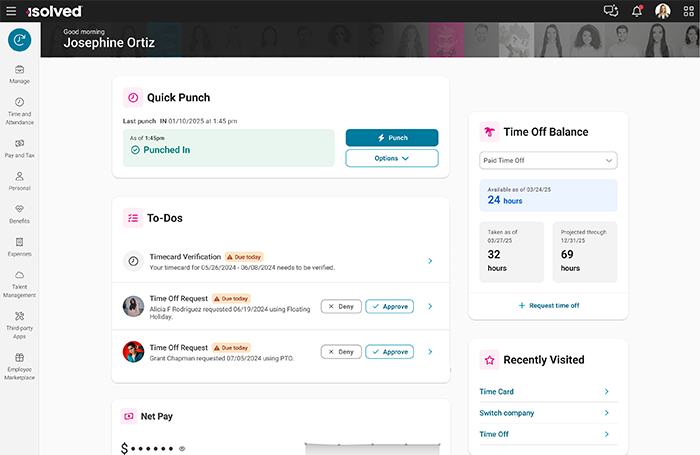

The HCM Platform Designed With People in Mind

When an organization's purpose and culture are top reasons someone might accept, leave or stay at a job, employers must provide a positive employee experience with consumer-grade technology at work.

isolved People CloudTM is a modern HCM platform that puts the employee’s HR experience front and center, and effortlessly adapts to future-proof organizations. You can seamlessly manage the entire employee lifecycle, from pre-hire to retire, in one place.

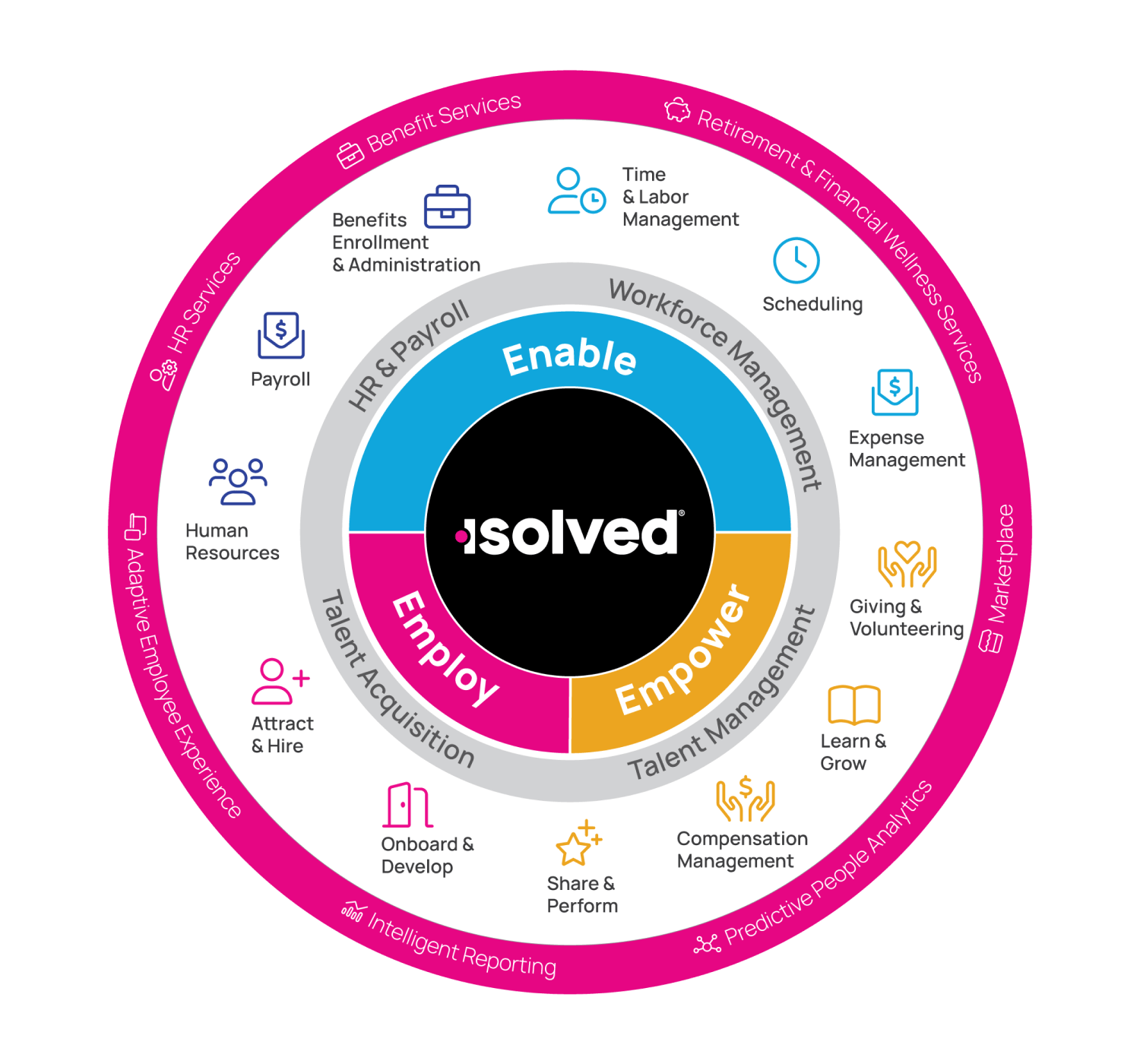

HCM Built for the Future of Work

HR, Payroll & Benefits

Our human resources software streamlines HR processes, securely stores and centralizes employee data, provides employee self-service and delivers a simple benefits experience, all while giving you the ability to process payroll efficiently, accurately and on time, every time.

Talent Acquisition

Attract, recruit and hire top talent while helping new employees become productive fast. With isolved, you can eliminate paperwork and redundancies from the recruiting and onboarding processes.

Workforce Management

Accurately track, manage and process time, scheduling and expenses for your entire workforce—even remote or mobile employees—while offering effortless online benefits and streamlined services that save precious time and money.

Talent Management

Enable employees to stay connected, share ideas, seek feedback and collaborate—while improving productivity and boosting performance. Access a robust system designed for employees to learn, manage compensation and more—elevating the employee experience.

People Cloud™ Mobile App

Empower your employees with access to essential HR information at any time, from any device!

Available in the Apple™ and Android™ app stores.

Flexible, Intuitive Human Capital Management

Comprehensive, completely scalable HCM software that supports a better work-life balance for your people and transforms your organization. Manage all your people processes—payroll, human resources, benefits, time and talent—in one secure location.