Put Lifestyle Benefits to Work—Your Way

Give employees employer-funded stipends for fitness, mental health, remote work, learning and more, while keeping your budget on track. With isolved, lifestyle spending accounts (LSAs) are easy to create and manage with integrated payroll, quick reimbursements, clear tax handling and real-time reporting.

Why Choose isolved for LSAs

LSAs help you strengthen culture and retention with meaningful, modern perks. isolved People Cloud™ unifies plan design, communication, participant self-service, reimbursements and analytics. You set the categories, allowances and rules. We handle automation, approvals, taxability and payments so your team can focus on people, not paperwork.

Benefits for Your Employees

Choose from flexible, company-approved lifestyle categories that support well-being.

Get reimbursements fast with a benefits card or mobile app with receipt capture.

Track balances, allowance schedules and get helpful notifications in real-time.

Access inclusive options that support diverse needs—wellness, caregiving and more.

Get clear guidance during open enrollment and ongoing support all year long.

Benefits for Your Business

Attract and retain the right talent with personalized perks that make an impact.

Control costs with predictable monthly, quarterly or annual allowances by group or location.

Automate tax handling with configure taxable vs. non-taxable items and optional gross-ups.

Reduce risk and manual review with policy controls and substantiation workflows.

Gain insights with dashboards and exportable reports for HR, finance and leadership.

Popular LSA Categories We Support

Give employees meaningful support in the areas that impact their lives the most:

Wellness and fitness: gym memberships, fitness classes, wearables.

Mental health and mindfulness: apps, coaching, classes.

Remote and home office: equipment, internet, ergonomic gear.

Professional development: courses, conferences, certifications.

Family and caregiving: dependent care, adoption or fertility support (per plan rules).

Commuting and transportation: transit, parking or micro-mobility (or pair with pre-tax commuter benefits).

Financial wellness: student loan assistance, budgeting tools.

Tax treatment varies by category and jurisdiction. isolved helps configure and report accordingly.

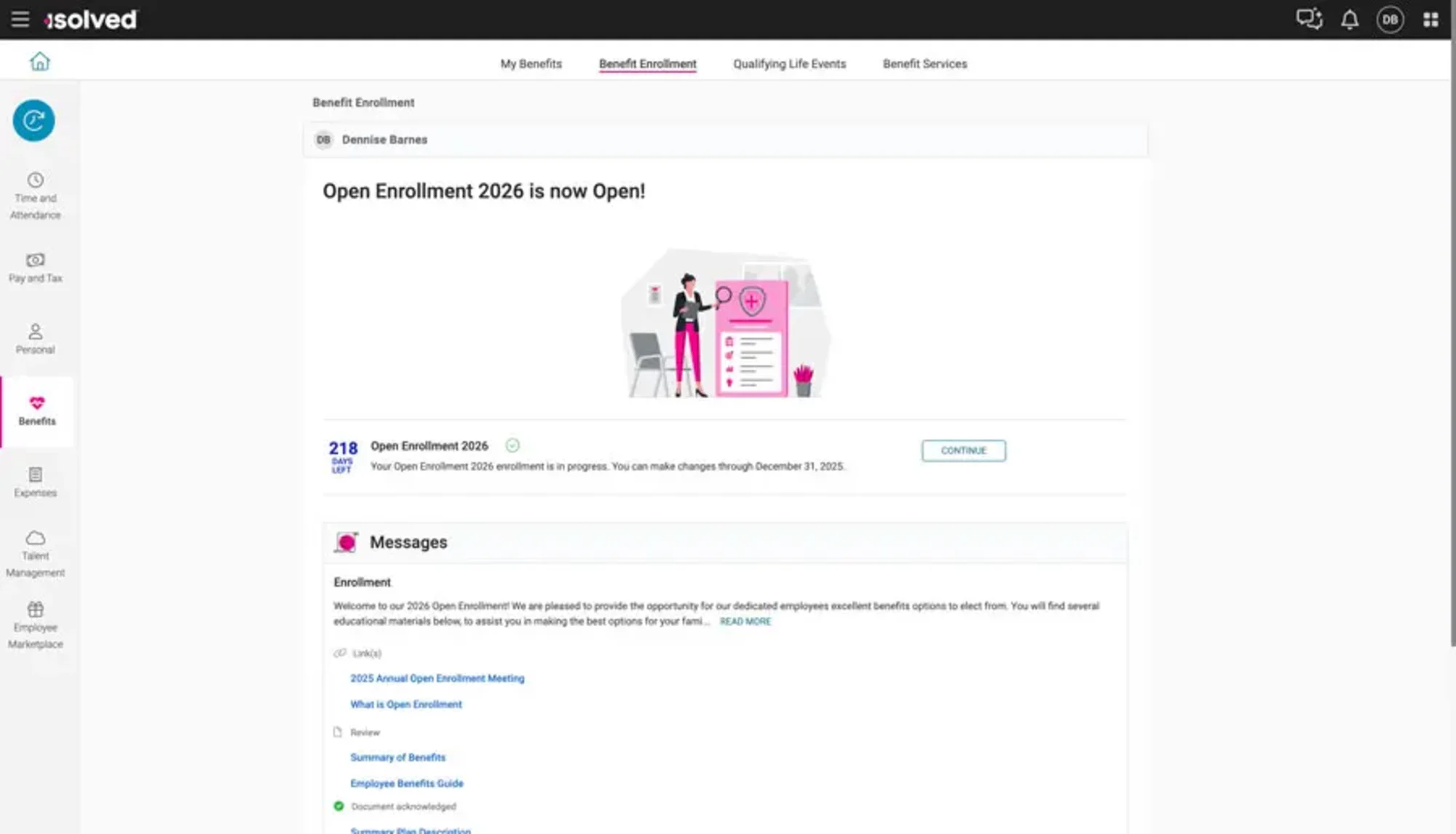

How LSAs Work in isolved

Configure your plan with categories, eligibility, allowance amounts, cadence and rollover rules.

Enroll participants and publish program details in the People Cloud platform.

Spend and submit using the benefits card or file claims in the app with receipt capture.

Manage your program through automated approvals, tax handling, reimbursements and analytics.

Lifestyle Spending Account FAQs

Get clear answers to common questions about lifestyle spending accounts (LSAs). Whether you're structuring your benefits package or exploring options to support employee satisfaction and well-being, these FAQs provide practical guidance for HR leaders managing flexible, employer-funded benefit accounts.

Deliver Perks People Love Without the Admin Lift

See how LSAs in People Cloud provide flexible, culture-building benefits with clear budget control.