Benefits Limits for 2023

Monday October 30th, 2023

Estimated time to read: 1 minute

With a new year approaching it’s time to ensure your clients are up to date with employee benefit plan limits. For your convenience, here’s a reference list. And for comparing year-to-year changes, limits for 2023 and 2024 are included.

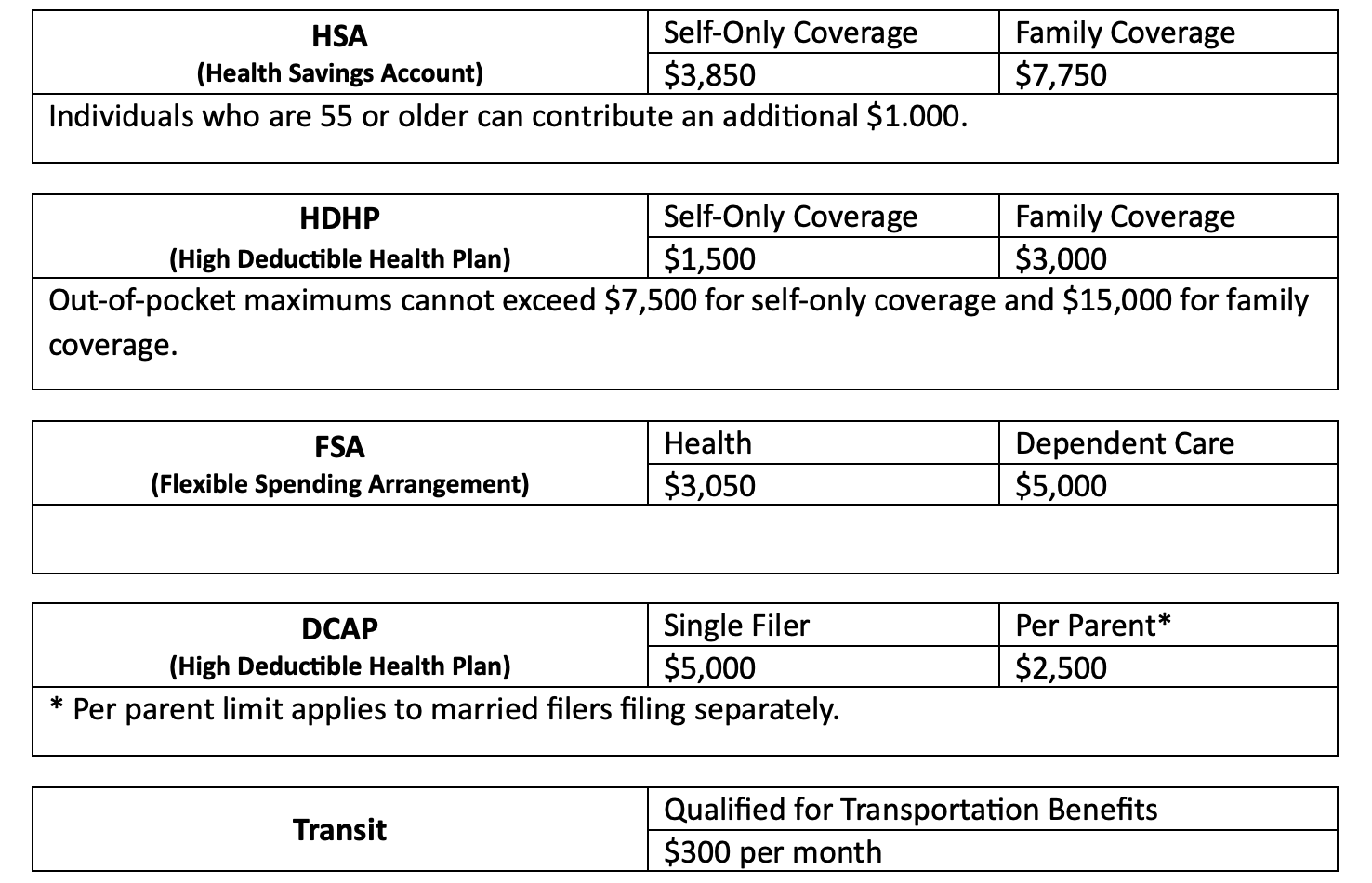

Benefits Limits for 2023

HSA (Health Savings Account)

The HSA contribution limits are $3,850 for self-only coverage and $7,750 for family coverage. Individuals who are 55 or older can contribute an additional $1,000.

HDHP (High Deductible Health Plan)

The HDHP limits are $1,500 for self-only coverage and $3,000 for family coverage. Out-of-pocket maximums cannot exceed $7,500 for self-only coverage and $15,000 for family coverage.

FSA (Flexible Spending Arrangement)

The FSA contribution limit is $3,050 for health FSAs and $5,000 for dependent care FSAs.

DCAP (Dependent Care Assistance Program)

The DCAP limit is $5,000 for single filers and $2,500 per parent for married filers filing separately.

Transit

The transit limit is $300 per month for qualified transportation benefits.

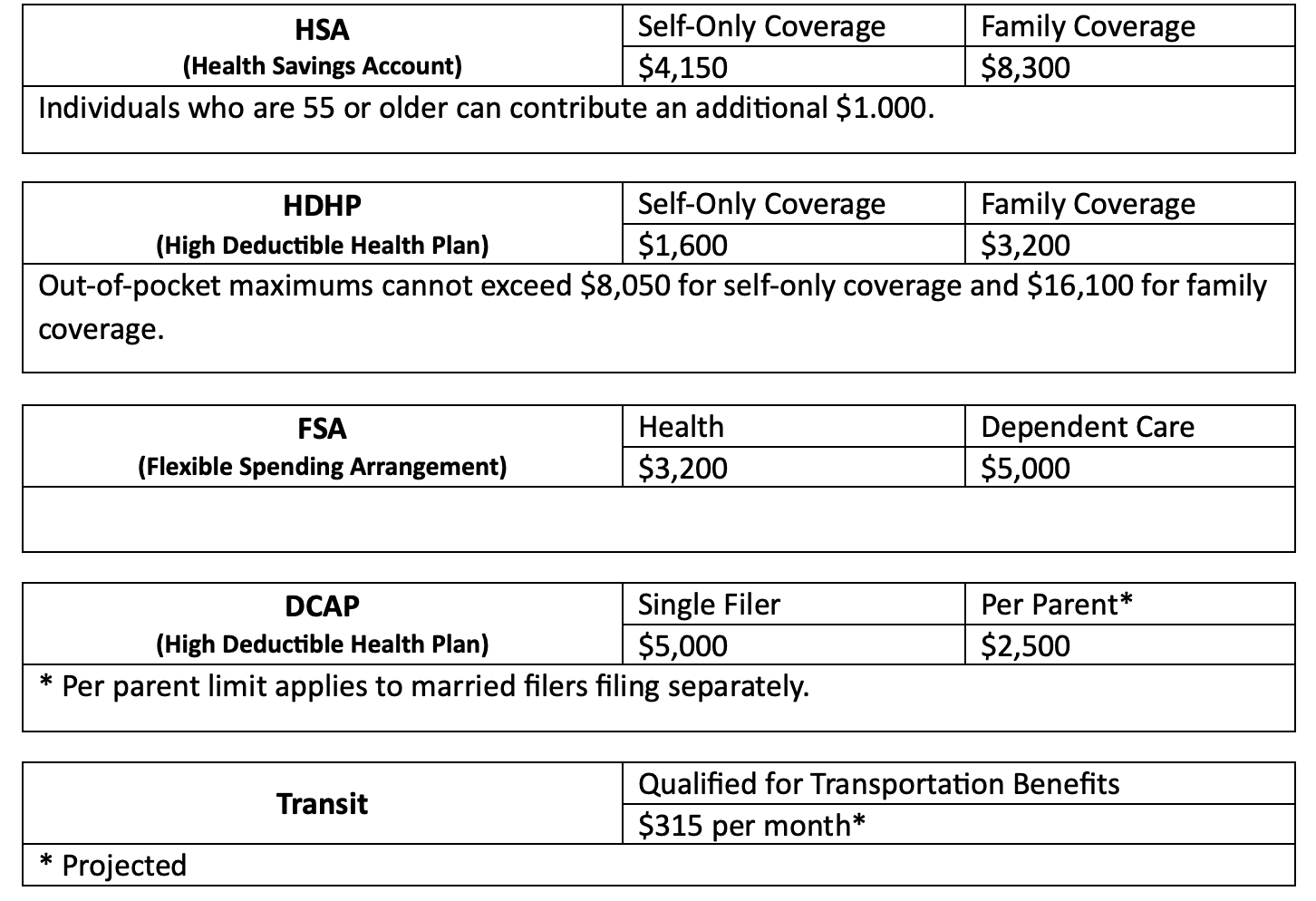

Benefits Limits for 2024

HSA (Health Savings Account)

The HSA contribution limits are $4,150 for self-only coverage and $8,300 for family coverage. Individuals who are 55 or older can contribute an additional $1.000.

HDHP (High Deductible Health Plan)

The HDHP limits are $1,600 for self-only coverage and $3,200 for family coverage. Out-of-pocket maximums cannot exceed $8,050 for self-only coverage and $16,100 for family coverage.

FSA (Flexible Spending Arrangement)

The FSA contribution limit is $3,200 for health FSAs and $5,000 for dependent care FSAs.

DCAP (Dependent Care Assistance Program)

The DCAP limit is $5,000 for single filers and $2,500 per parent for married filers filing separately.

Transit

The transit limit is $300 per month for qualified transportation benefits.

This bulletin has been read 5,559 times.