Compliance Corner: New Final Overtime Rule

Posted: 06/28/24

The Fair Labor Standards Act (FLSA) recently introduced a new, final overtime (OT) rule, bringing significant changes for employers and employees. To help you understand its key aspects and implications, we interviewed isolved's Senior Director of HR Solutions, Karyn Rhodes. Read on to discover what business leaders should know.

Can you explain the key changes introduced by the final OT rule?

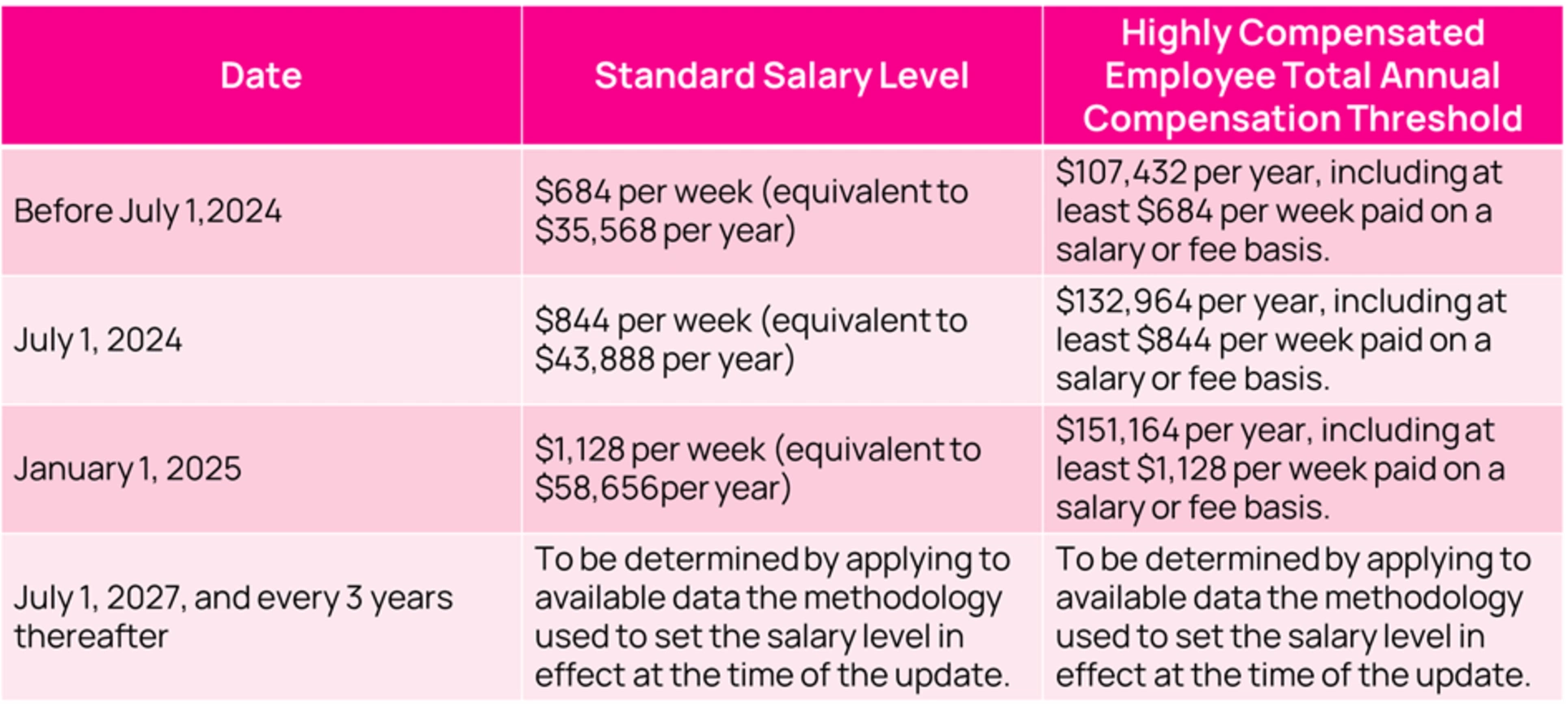

The new rule mandates that exempt executive, administrative and professional employees must be paid at least:

$844 per week ($43,888 per year) beginning July 1, 2024

$1,128 per week ($58,656 per year) beginning January 1, 2025

Additionally, highly compensated employees (HCE) must be paid on a salary basis and receive at least:

$132,964 beginning July 1, 2024

$151,164 beginning January 1, 2025

Why are these changes significant?

Employers will need todecide on a course of action and plan for how those changes will be implemented. There are three main steps employers need to take when deciding their course of action:

Identify which exempt employees might be affected.

Calculate the hours worked by these employees.

Evaluate the options and decide how, and how much, these employees will be paid.

How will the new rule impact employees who are currently exempt?

Employees classified as exempt and earning less than $43,888 need to be identified. It’s important to include total incentive pay (e.g., bonuses, commissions, or any other incentive pay).

Employers must either:

Increase their pay to $43,888 by July 1, 2024.

Reclassify them as hourly nonexempt and determine a new hourly rate on their current salary. They will be entitled to overtime pay.

Calculate a cost-neutral rate of pay for nonexempt employees. They will be entitled to overtime pay.

Reclassify them as salaried nonexempt, paying them the same weekly rate for 40 hours or fewer and overtime for any additional hours over 40 in a workweek.

Who is covered by the FLSA?

The FLSA applies to employers with:

At least two employees engaged in interstate commerce with at least $500,000 in gross annual business

Hospitals, residential care facilities or schools

Public agencies

Covered employees include those involved in interstate commerce, domestic service workers like housekeepers, full-time babysitters, and cooks, even if the employer isn't a covered enterprise.

What are the salary thresholds under the final OT rule?

Are there any exceptions to the final OT rule?

The FLSA provides exemptions from the minimum wage and overtime provisions for employees in an executive, administrative or professional capacity. The “White Collar” exemptions include:

Salary Level Test

Salary Basis Test

Duties Test

Exempt employees must be paid their full salary for any week they perform work and must meet the above criteria.

Does the final OT rule apply to employees of nonprofit entities, such as religious organizations?

Nonprofit entities, including religious organizations, are generally subject to the same rules. If these organizations engage in interstate commerce (e.g., ordering from Amazon), they must comply with the FLSA.

What does the rule mean for highly compensated employees?

Starting July 1, employees earning $132,964 or more will be classified as exempt from overtime provisions. These employees must meet the duties test and the salary level for the Exempt status.

How can your business avoid FLSA violations?

To stay compliant, businesses should:

Conduct an internal audit to identify impacted employees

Establish internal policies and controls

Stay informed on FLSA rules and guidance

Train managers, supervisors and employees

Understanding the complexities of the new overtime rule is crucial for employers. If you have questions, we recommend consulting with an HR expert. Discover how isolved HR Services can help you keep up with evolving laws.

HR and Payroll Without the Headaches

Free your team from payroll stress with solutions that scale as fast as your business.

Author: Karyn Rhodes

Related Posts

Compliance Corner: OSHA Form 300A and isolved Safety Solution

HR Trends: 7 Strategic Shifts Every HR Leader Should Know

Discover the 7 HR Trends to Watch in 2025 and the top shifts impacting workplaces.

Read More

Compliance Corner: One Big Beautiful Bill—IRS Update on Qualified Overtime Deductions

The IRS just clarified the One Big Beautiful Bill’s qualified overtime deduction. Learn who’s eligible under FLSA, what counts as deductible overtime and what payors need to know about 2026 reporting.

Read More